Uninsured Moms

The instability in insurance coverage for women during pregnancy and after childbirth can result in differential access to essential health care, impacting the health of both mothers and newborns.

Read Time: 3 minutes

Published:

Pregnant women and women who recently give birth are too often uninsured. Jamie Daw and colleagues in a recent article for Health Affairs describe the scope of the problem with health insurance changes, or churn, for these women. Churn can result in a lack of access to prenatal and postpartum care for women. Both are essential for the well-being of the mother and newborn.

Every state has a gap in Medicaid eligibility for pregnant women and parents or adults. For example, New York’s Medicaid system covers pregnant women up to 223% of the Federal Poverty Limit (FPL) and parents up to 138% of FPL. In the complicated world of health insurance coverage, pregnancy and childbirth often mean different options for women. Medicaid covers eligible pregnant women from conception to 60 days after childbirth. After 60 days, women must requalify for Medicaid under a lower threshold for parents, enroll in a private insurance plan, or simply be uninsured. Even though the Affordable Care Act requires maternity coverage, pregnancy is not a criterion to enroll during special enrollment periods (SEPs). Childbirth, however, is a SEP eligible event.

Women most likely to experience loss in insurance coverage after childbirth are those who are unmarried, covered under Medicaid or CHIP during the delivery, live in southern states, fall between 100% to 185% of FPL, or do not speak English at home.

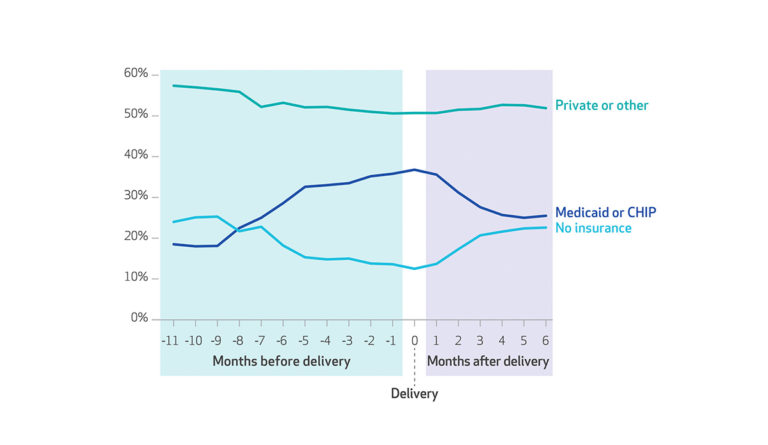

Daw’s study found that churn between programs disproportionately affects women who are uninsured or covered by Medicaid at the time of conception. Privately insured women remained relatively stable in health insurance coverage. The number of uninsured women decreases up to the time of delivery with the lowest rate of uninsured during the month of childbirth. After delivery, the percentage of uninsured women rises and the percentage of Medicaid or CHIP eligible falls. Only 41% of women covered by Medicaid or CHIP have the same insurance in the six months following childbirth. The uninsurance rate after delivery returned to about the same rate as before conception.

Women most likely to experience loss in insurance coverage after childbirth are those who are unmarried, covered under Medicaid or CHIP during the delivery, live in southern states, fall between 100% to 185% of FPL, or do not speak English at home. Even women who change insurance but do not have a gap in coverage face obstacles. Daw and colleagues describe that a change in health plans can increase the chance of postponing care due to cost by 65% and lessens the odds of having a usual source of care by 37%.

The instability in insurance coverage for women during pregnancy and after childbirth can result in differential access to essential health care, impacting the health of both mothers and newborns. States should craft policies that promote continuity in coverage for reproductive-age women.

Databyte via Jamie Daw, Laura Hatfield, Katherine Swartz, and Benjamin Sommers, Percentages of Women who Gave Birth in the Period 2005-13, By Health Insurance Type and Month Before or After Delivery. Health Affairs.