Emergency Cash for Coverage

The chilling reality faced by millions of Americans with unplanned emergency medical costs remains: Where do I turn for help?

Read Time: 2 minutes

Published:

Winter is all around you. Overnight the temperature slipped below thirty, so you were especially careful getting to work. You put on your heaviest jacket, dodged the frozen puddles, spent extra time warming the car. Despite all the preparation, the black ice crept up too fast. Your car spun out of control and slid into a ditch. The car was not damaged, but the paramedic sent you to the emergency room to have that large bump on your head checked out. A few days rest and you’ll be back up on your feet in no time. Weeks pass. You heal and you forget about the accident. Then the hospital bill arrives. You had medical insurance, but you still owe $1,000.

How will you pay?

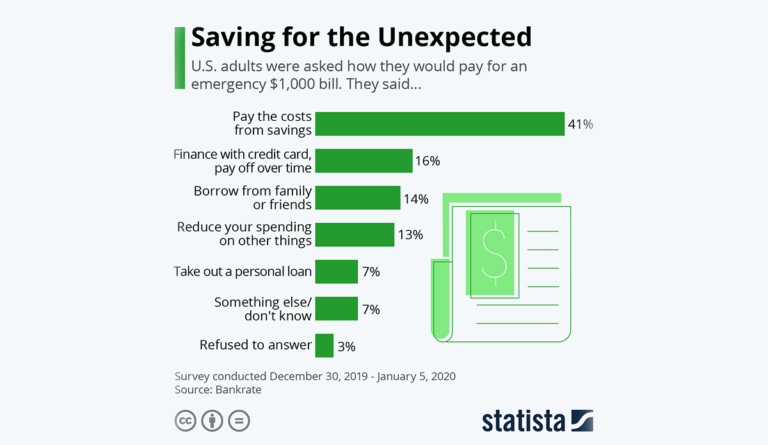

To find out how Americans think about surprise bills like these, BankRate interviewed 1,015 people. Most reported they would pay with their savings, while the rest said they would use a credit card or borrow from a bank or friends. Similar findings have been reported by the Federal Reserve and Pew Research Center.

If they liquidated all of their assets, just under half of all Americans would only be able to produce $2,000 to pay surprise bills. Although this might cover the cost of your head injury, you could have damaged your car. Or what if, instead of a bump on your head, you’d broken your leg?

More severe emergencies like treatment for a broken leg can cost over $7,000 for a visit to the emergency room. Health insurance can partially protect individuals from these costs, but nearly 27 million nonelderly Americans currently live without any kind of health coverage.

The chilling reality faced by millions of Americans with unplanned emergency medical costs remains: Where do I turn for help?

Databyte via Maria Vultaggio, “Saving for the Unexpected.” Statista. 23 Jan. 2020.