Ensuring Insurance Profits

Right now, insurance companies can speed up rebates or help invest in local public health initiatives to address Covid-19.

Read Time: 2 minutes

Published:

The use of medical care has changed drastically since Covid-19 landed on American soil. Many hospitals and providers delayed elective or non-emergency procedures and visits, drastically increasing the usage of telemedicine. Patients stayed home and delayed care for chronic problems and preventive care while hospitals filled with Covid-19 cases, and small private providers and large medical corporations alike watched income plummet due to the drop in medical utilization.

All the while, health insurance companies silently bagged profit windfalls. Insurance companies pay for medical services, and when services decline, they save money while continuing to collect monthly premiums.

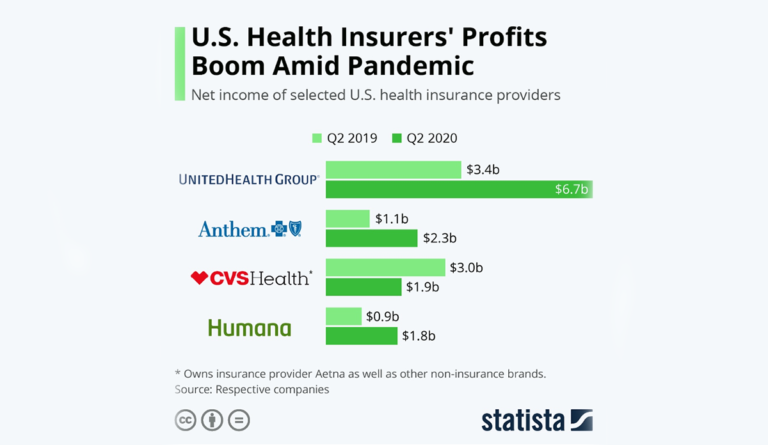

As the above graph illustrates, United Health Group saw $6.7 billion worth of profits in the second quarter of 2020, compared to $3.4 billion in 2019. Similarly, Anthem had more than doubled their second quarter profits in 2020.

So, what happens to the profits?

In normal circumstances, insurance companies are required to return some of the funds to subscribers. But this requirement has a lag. Medical insurance profits are measured over a three-year average, meaning insurance companies may not return profits generated in 2020 until 2023. In the interim, hospitals and providers continue to struggle under the weight of the pandemic and many families tread through job loss and Covid-19 illness trying to make ends meet.

Right now, insurance companies can speed up rebates or help invest in local public health initiatives to address Covid-19. We can’t afford for them to do nothing.

Databyte via Niall McCarthy, “U.S. Health Insurers Profits Boom Amid Pandemic.” Statista. 11 August 2020.